Dubai’s exclusive metropolitan transformation has enhanced its standing as the most dynamic real estate market globally. At the core of this evolution lies thoughtful infrastructure advancement driven by community megaprojects, public transit expansion, airport upgrades, and road networks. Such developments systematically shape demand and property valuations.

Dubai’s infrastructure initiatives are distinguished as key catalysts of rental returns and capital growth due to the homebuyers’ and investors’ surging emphasis on lifestyle and connectivity access.

On the large scale, the United Arab Emirates has stolen 5th spot for well-maintained roads, ranked 10th for its seamless public transportation system, and 9th for its expedited port operations. This report by the World Economic Forum justifies the endless contributions of the UAE government in redefining the basic concept of urbanism.

Likewise, Dubai’s long-term blueprint places infrastructure at the heart of real estate value creation. These developments essentially translate into property price movements and investment potential.

Infrastructure Investment: The Foundation of Dubai’s Real Estate Growth

Dubai follows a strategic approach to infrastructure that takes it beyond municipal and utilities’ investment. Such projects deliberately shape the real estate market of Dubai with a central focus on utility networks, seamless transport systems, and smart city components.

Moreover, authorities are consistently leveraging cutting-edge techniques to make the communities more accessible, desirable, and economically vibrant. The investment of AED 175 billion in infrastructure advancement in the previous 20 years has transformed Dubai’s standing on a global level, according to the emirate’s ruler (Sheikh Mohammed Bin Rashid Al Maktoum).

The Dubai 2040 Vision is ingrained as the wide-scale, human-centric strategy and keeps connectivity as well as growing transportation networks as central pillars of regional growth. Substantial improvements in connectivity, either through a metro extension, new highway, or airport expansion, ultimately accelerate the attractiveness of nearby real estate.

New Metro Lines: A Catalyst for Property Demand and Price Growth

The metro network in Dubai, comprising Green and Red Lines, has long been recognized for its revolutionary effect on property values. Real Estate within a 15-minute walk of a metro station has witnessed a record surge in the macro markets. Areas like Al Furjan, Business Bay, and Downtown have outperformed in price increases over historical periods.

Adjacency to metro infrastructure is essential to reshaping desirability. From enhanced daily mobility, lessening commuting stress, and close alignment of residential properties with workplaces, amenities, and schools, real estate valuations have encountered an exceptional rise. This infrastructure development also supports the urban districts where traffic congestion might otherwise deter buyers.

1. Blue Line Metro

The forthcoming metro expansion with the Blue Line project is anticipated to further amplify value. It will stimulate real estate prices in Dubai by 3.5% to 5.2% by mid-2026. Rental returns and resale values will undergo immense growth, particularly in areas like Academic City, Al Furjan, Arjan, and JVC.

These enhancements will boost connectivity between emerging districts and will turn previously overlooked zones (Academic City, Ras Al Khor Industrial Area, and DCH) into premium community-friendly districts.

2. Highway and Road Enhancements: Addressing Congestion & Optimizing Efficiency

i. Al Khail Road & Traffic Corridor Enhancements

Al Khail Road, a 15-kilometer-long arterial route in Dubai, has become active for high-end improvements. In 2024, the RTA (Roads & Transport Authority) received the game-changing contract for the Al Khail Road Improvement Project. The contract, worth Dh700 million, ensures exclusive enhancement in traffic corridors. It also involves the construction of 5 bridges and is expected to result in an exceptional reduction in travel time by 30%.

ii. Highway Linkages

The year 2025 marked a milestone moment for Dubai on the global investment forum, as Dubai Holding and RTA agreed on a Dh6 billion project in March 2025. This game-changing agreement tends to lessen commute time by 70% by developing multiple interchanges and intersections of Sheikh Zayed Road. Key areas to benefit from this accord include International City Phase 3, Dubai Production City, Palm Jumeirah, JVC, and Business Bay. Though enhancing travel times between residential and economic zones, these improvements will largely impact Dubai-centric property values.

If you are interested in buying or rent property in Dubai, here's the best options for you:

AED 84,000 / Yearly

Chiller Free & High Floor Studio Apartment for Rent in Zumurud Tower, Dubai Marina

Dubai Marina

AED 1,613,671

Luxury 1-Bedroom High ROI Apartment for Sale in Woodland Crest, Meydan Avenue

Meydan

Airport Upgrades: Launch-Pads for Local Property Wealth

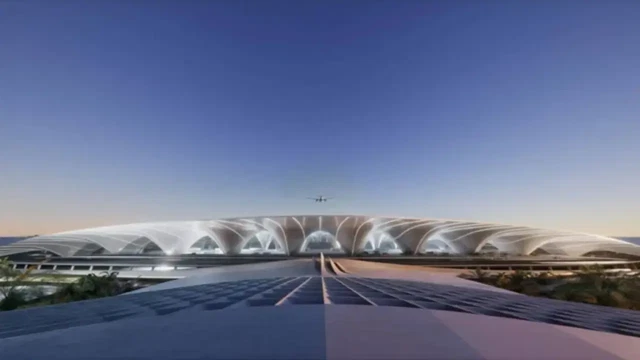

Dubai’s aviation infrastructure is another massive driver of real estate value. The role of DXB and Al Maktoum International Airport in global connectivity is widely acknowledged, and real estate markets feel the effect clearly.

1. DWC Expansion & Dubai South Properties

The whopping Al Maktoum International Airport has been undergoing phased expansion to become the largest airport globally. With roughly AED 128 billion projected investment, the airport intends to encompass 400 gates and 5 parallel runways to handle over 260 million passengers yearly by the 2030s. Such a massive expansion program will simultaneously bolster Dubai South and neighboring communities’ real estate appeal.

Close proximity to an international airport not only features convenience for travelers but opens gateways for job markets, a surge in business tourism, and significant support to the logistics network. The exceptional inflow of passenger capacity through the airport's dynamism will steadily boost demand for commercial and residential units.

Mega Projects and Iconic Developments: Powerful Value Drivers in Real Estate

1. Expo City

Dubai has kept the enduring legacy of EXPO 2020 enlivened through its master-plan project (Expo City Dubai). This emerging neighborhood has transitioned from a global showcase site into an innovative commercial and residential district. The community is anticipated to experience steady growth in property values, thanks to the presence of the metro and its ingrained roots in sustainability.

2. Dubai Islands

Large-scale developments like the Dubai Islands exhibit ambitious contributions of the Dubai government in waterfront urbanism. From integrated transit access to premier waterfront living, such mega-communities reinforce desirability for their fusion of recreation, lifestyle, and retail. The community-oriented infrastructure often turns these sites into flagship property markets.

3. Community and Lifestyle Infrastructure: Bolstering Appeal

Though connectivity and transport serve as the infrastructure’s backbone, lifestyle provisions exhibit equally transformative contributions when linked with property valuations. For instance, Dubai Healthcare City Authority has recently disclosed its Dh 1.3 billion development plan in October 2025, which is set to anchor the emirate’s first LEED Platinum-certified flagship project.

These lifestyle enhancements don’t elevate quality of life only, but also increase the functional value of living spaces. Moreover, communities developed with holistic infrastructure often drive higher demand from expats and families chasing a balanced environment.

Measuring Success: The Impact Uncovered

An RTA-commissioned report, executed by McKinsey & Company, revealed a dramatic increase of 16% in property values through transport and infrastructure projects in Dubai. The surge has been specifically witnessed in connected neighborhoods where high expansions and metro lines have shortened travel times.This underscores how tangible infrastructure improvements translate into higher capital appreciation across diverse sectors of the city.

Even in the markets worldwide where mobility accelerates access to urban economic nodes and shortened commute, stress has witnessed the greatest changes in upward price momentum. The UAE’s integrated approach has tremendously catalyzed this effect across several regional hubs.

Investor Perspectives: Strategies & Risk Management

Understanding the impact of infrastructure on property values involves predicting future demand curves among real estate investors rather than just observing current trends.

1. Early Entry & Proximity Premiums

Real estate across the city adjacent to planned infrastructure corridors (highway links, airport expansion, and newer metro lines) typically faces early premiums. A property purchase, within a specific radius threshold, before completion, enables investors to capture the uplift as community activity expedites, and the project goes live.

2. Diversification across Connected Nodes

Diversified investments across several nodes of high infrastructure investment enable investors to balance risk and benefit as lifestyle-oriented projects, airport-adjacent communities, and metro hubs form varying growth corridors in Dubai’s market.

Smart investors, however, are capable of monitoring supply dynamics and project delivery timelines. If supply substantially exceeded demand, rapid unit deliveries could put downward pressure on prices in 2026.

As per our recommendation, these are the best options for you to buy offplan property in Dubai:

Price on Request

The Brooks by Sobha

Sobha Sanctuary

Starting from AED 1,270,000

Vista Ridge by Emaar

Emaar South

The Future Outlook: From 2026 and Beyond

Dubai’s infrastructure-first philosophy shows no signs of slowing. Property markets, in the long-term plan, tend to retain their boastfulness, thanks to layered urban amenities, expanded transit systems, and smart city solutions.

Furthermore, cutting-edge mechanisms by the Government of Dubai suggest a close link between digital infrastructure and future real estate growth. Such an evolution, driven by smart utilities and digital ecosystems, extends transformation beyond traditional transportation projects.

The city’s also planning to continuously diversify its economy and pull global capital. The economic-diversification strategy will drive population growth, keeping the growth long-term and property prices resilient.

Closing In!

Mega projects and infrastructure advancement in Dubai have remodeled the city’s property landscape. Beyond connectivity, a consistent real estate value upsurge is what lies beyond the tangible goals. From airport developments and metro expansions to lifestyle-centric communities, strategic infrastructure has underpinned investor confidence and capital appreciation.

Dubai stands as a testament to uplifting community valuations and ongoing investments into future-forward urban systems, thanks to its strong infrastructure plan that backs real estate performance.

Whether you’re a homebuyer or an investor, understanding the interplay between infrastructure and property values remains crucial for strong decision-making. Such in-depth clarity also unlocks vibrant paths to the world’s most dynamic markets.

Explore More...