The robust economy, sound political infrastructure, and lucrative real estate investment returns make Dubai an attractive place to invest in real estate. Among buyers in the region, off-plan property investment is a hugely popular option.

Over the years, Dubai’s real estate market has seen a lot of interest from potential international and local buyers when freehold properties became available to ex-pats. The trend of more real estate launches and announcements appears to continue.

What is Off-Plan Property?

Purchasing real estate before it is built is known as buying off-plan. In this agreement, the developer and the buyer both commit to the buyer purchasing the property according to the plans and specifications even before the construction is completed.

Although the potential for large returns makes purchasing off-plan homes and developments alluring, there are quite a few pitfalls and difficulties associated with this type of investing.

The popularity of a neighbourhood and its locality are important factors influencing the appreciation of property values today. Best off-plan projects in Dubai are increasingly becoming part of well-rounded communities in their surrounding areas at the time of purchase, which helps increase the market price. The project must also be popular in the market for an off-plan property investor to get quick profits.

What Is the Process of Buying Off-Plan Property in Dubai?

1. Decide the type of property you want to settle with

First things first. Dubai real estate cluster is very saturated with countless players competing to secure a foothold in the market. Therefore, listing down your key property requirements such as budget, type of property, and a suitable real estate agent are the key factors to focus on at this stage of your off-plan house purchasing process.

Get a mental grip on the initial specifics such as the type of property developers you prefer, ROI estimates of the Dubai off-plan properties – if they match your budget and whether they offer flexible installment plans, preferred locations, and your most preferred community neighbourhoods.

2. Keeping up with a well-reputed and experienced licensed real estate agent or real estate agency

To assist you in locating the ideal off-plan property, select a reputable and knowledgeable broker with a positive background in driving down commissions or a licensed real estate company with solid partnerships with highly esteemed developers.

This is important because a real estate agent is responsible for everything that is congruously planned and executed taking into account the handling of the contract terms and the handover procedure.

In keeping with regular sales data updates, realtors have a clear idea of the market and so will be able to hand-pick properties based on your tastes and financial constraints. The Dubai Land Department and RERA (Real Estate Regulatory Agency) Dubai are two places where a reputable off plan property realtor would be registered.

3. Selecting and booking the right property from the list

The sooner you’ve picked a real estate agent and disclosed to your realtor the best property preferences suiting your budget, expect a distilled checklist of the short-listed off-plan properties that think can fill your expectations.

If these properties match, the realtor will invite you for a scheduled property viewing for a visual inspection of your most desired properties. If it’s an off-plan property, you may be allowed to take a look at the mock properties on display at the showrooms.

Making an informed decision can be nerve-wracking therefore make sure to do background checks at this stage because your next move would be to make the booking upon selecting the right property unit which comes with a 10% charge.

To complete this, the developer can request you to sign the Sales Purchase Agreement (SPA) along with the booking form.

4. Payment of the first installment and signing of the Sales and Purchase Agreement (SPA)

Based on the payment plan of your property, the next step would be making your first installment or down payment. With that another 4% DLD registration fee and an Oqood fee of 1000 dirhams must be settled within the next 30 days for governmental authorization and registration of booking the property.

If you have any questions regarding these fees you may ask the developer for further clarity. By now you should receive the Sales and Purchase Agreement (SPA) which is the initial contract sent by the Dubai Land Department.

5. Settling due installments and project completion date

When buying off-plan in Dubai, the developers arrange a flexible payment plan to be paid in installments within a specific timeframe. Only after these installments are made, you are officially eligible to be handed over the property once completed. Generally, these price plans are capped as follows:

- 80/20% – 80% covered during the construction stage and 20% paid upon handover

- 60/40% – 60% covered during the construction stage and 40% paid upon handover

- 50%/50% – 50% covered during the construction stage and 50% paid on handover

6. Final inspection and handover of the keys

The final handover payment is expected to be paid to move on to the next step which is site inspection of the completed property. Before handover, this is when you are invited by the developer to check on the property and whether it has reached your expectations, If yes, the property keys are handed over to move into your new home.

Reasons Why Invest in Off-Plan Property?

Sounds exciting? Below are a few reasons why off-plan property investment in Dubai is a feasible way to get into the real estate market:

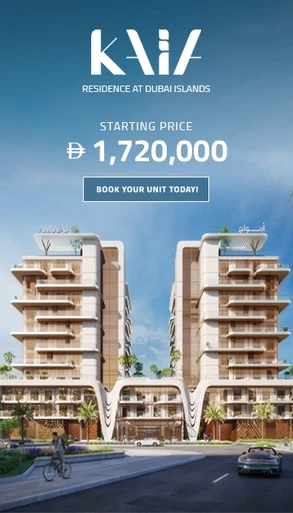

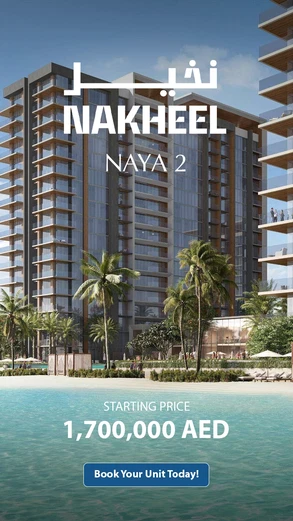

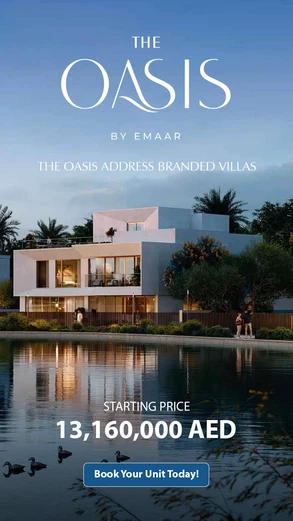

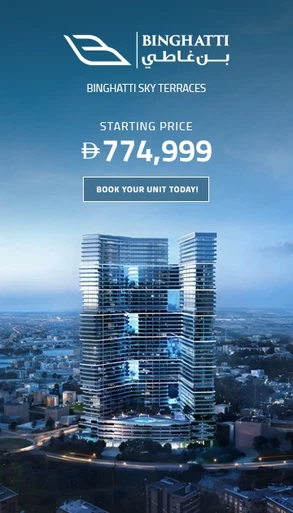

1. Dubai has an extensive range of off-plan projects

Off-plan property developments in Dubai are positively bustling with activity, from Downtown Dubai to new estates popping up on the outskirts.

In today’s marketplace, off-plan buyers have an even greater range of options than before, regardless of location, price point, and property type.

2. First owner = Brand new property

Selecting the desired floor plan and view is an option if you are purchasing a townhouse, villa, or off-plan apartment in Dubai. As they are consistently happier than owners of previously owned residences, first-time homeowners are invariably quite content.

3. Reasonable prices and adaptable payment schedules

Off-plan property for sale has the obvious advantage of being available at a much lower price than a property that has not even been constructed. In comparison to constructed developments, which have a higher value, off-plan property investments tend to be more affordable and practical due to attractive offers and flexible payment plans.

Off-plan properties in Dubai benefit first-time buyers as well as seasoned investors due to their lower price tags and greater flexibility. Many developers announce projects monthly, competing primarily on price and payment schemes.

4. Ownership in off-plan properties will result in a high rent yield with flexible payment plans

Property investment in the UAE is largely driven by rental income. Dubai will always have a demand for housing options due to the steady influx of ex-pats that walk into the country every year.

You will likely earn a decent rental income whether you buy off-plan or ready properties in Dubai, giving you financial security and a solid foundation for a long-term investment.

5. A capital investment with a high rent yield means high returns

Real estate investments in the UAE can earn impressive returns on investment (ROI), as it is one of the world’s fastest-growing economies that stays ahead of the curve. Even when a property is “locked in” before construction, its value is likely to rise after construction is completed.

Suppose you decide to sell before or after completion. In that case, you can expect significant capital gains even while you are paying off your investment in phases according to the developer’s payment plan.

6. Changes Dubai’s buyer protection law for capital investment

RERA (Real Estate Regulatory Authority) and the Department of Land Development (DLD) in Dubai have taken numerous measures to provide extra protection to buyers against delays, cancellations, or fraud when it comes to off-plan properties.

A rule that applies to buyers of off-plan properties is that payments must be made to banks approved by the DLD. Only after the project reaches completion will developers be able to access funds.

Off-plan property buyers gain more confidence when these measures are in place, making it a secure market in which to invest, safe in the knowledge properties will be delivered under normal conditions.

Want to express your interest? Contact Excel Properties to purchase your next home!

If you’re looking to buy an investment get in touch with us, your trusted property investment partner who will make it happen. Whether you’re starting a new thrilling adventure to move to a new home, or you’re looking for an investment opportunity, we have a lot of exciting new off-plan properties to show you in Dubai.