Investing in Dubai real estate is a topic that has garnered momentous engagement in recent years owing to the city’s prompt expansion initiatives and burgeoning real estate gaining sustainable market indicators.

As a global intersection for business, tourism, and luxury living, Dubai delivers a surfeit of investment possibilities for both local and international investors.

According to a recently published report, the real estate sector in the UAE observed a robust shift in the third quarter of 2023 with property prices continuously evolving even with macroeconomic challenges.

From the beginning of 2023 until September 2023, the average house price in Dubai saw an uptick of 19.6%. This rebound mirrors a healthy scope of investment opportunities for everyone in the retail, corporate, and residential settings.

Navigating the Dubai Real Estate Market

Alongside the government’s strategic efforts for a welcoming business climate away from its non-oil sector, the real estate market in Dubai has steadily picked up and encountered substantial transition and transformation over the past few decades, driven by strong facets such as population growth, economic diversification, and government initiatives to promote foreign investment.

The ever-maturing skyline today is festooned with iconic skyscrapers, luxury residential developments, and world-class commercial properties, making it an attractive destination for real estate investors seeking sky-high returns and capital appreciation.

A Brief Analysis of Dubai Real Estate Landscape

Before delving into the investment process, gaining a nuanced understanding of the Dubai real estate landscape helps with understanding its competitive edge.

The market is defined by a diverse range of property types, including residential, commercial, retail, and hospitality assets.

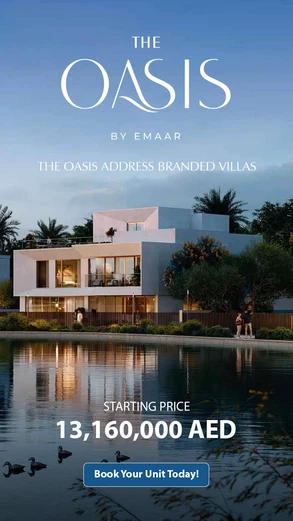

Residential properties in Dubai encompass apartments, villas, and townhouses, catering to varying lifestyle preferences and investment objectives.

Commercial real estate, on the other hand, comprises office spaces, retail outlets, and industrial properties that cater to the city's thriving business environment.

Moreover, the flexible visa policies, the increase in the number of trade licenses being issued, and the favorable tax laws in Dubai have collectively contributed to the buoyancy of the real estate sector.

Dubai Real Estate Latest Market Overview Comparison: July 2023 vs June 2024

The interplay between demand and supply remains a critical factor in shaping the Dubai real estate market overview. In July 2023, the market experienced a 59% sales transaction of off-plan residential units, leading to heightened competition and a 41% transaction completion in ready property sales.

Fast forward to June 2024, the market witnessed a gradual equilibrium between supply and demand, with an increase in the completion of transaction sales for off-plan residential projects with a 67% hike and a diversification of offerings to cater to a wider spectrum of buyers.

The ongoing efforts to align supply with market needs have contributed to a more sustainable and inclusive real estate landscape here in the UAE.

Source: https://dxbinteract.com/

Market Trends and Investment Opportunities

Staying abreast of market trends and identifying future-proof investment prospects is equally important. The city’s real estate market has witnessed fluctuations in property prices and rental yields in recent years, pulled up by consequential elements like supply and demand dynamics, regulatory changes, and global economic conditions.

The volatility and resilience of the real estate market in the UAE serve as valuable resources for grasping the complexities of sustaining active demands among the influx of investors.

According to the property market report published on DXBInteract, as of June 2024, there has been a total of 14,370 sales volume marked by a 37.4% increase yearly compared to June 2023.

Transaction deals continued their momentum for apartments with a sales value of AED 20 billion with a total of 10,644 units sold and 1,615 villas amounting to a sales value of AED 8.5 billion, respectively.

Addressing the Legal and Regulatory Considerations

Navigating the legal and regulatory framework is paramount when investing in Dubai real estate, especially for international investors.

The Dubai Land Department (DLD) oversees the regulation and registration of real estate transactions in the emirate, ensuring transparency and investor protection.

Foreign investors must adhere to specific ownership regulations, which may entail engaging local sponsors or establishing corporate structures to hold property assets.

Financing Strategies and Flexible Investment Practices

Financing is a critical aspect of investing in Dubai and the city does offer options in the manifold for investors to fund their property acquisitions.

Local and international banks provide mortgage facilities to eligible individuals and entities, enabling them to leverage their capital and expand their real estate portfolios.

Besides, investors can explore alternative financing avenues such as private equity, joint ventures, and real estate investment trusts (REITs) to diversify their investment strategies and optimize returns.

In Dubai, property developers also offer a variety of flexible payment plans to attract potential buyers. These plans are designed to make property ownership more accessible to a wider range of individuals, including first-time buyers, investors, and expatriates.

One common type of flexible payment plan is the post-handover payment plan, which allows buyers to pay a certain percentage of the property value during the construction phase and the remaining amount after the property is handed over.

This type of plan is particularly desirable to buyers who may not have the full amount for a down payment but can make regular payments over time.

Another popular option is the extended payment plan, which allows buyers to spread their payments over an extended period, often up to 5 or 10 years, with minimal interest or no interest at all.

This type of plan appeals to buyers who prefer smaller, more manageable payments over a longer period. Some developers however do offer customized payment plans aligning with the needs of individual buyers, taking into account their financial preferences.

Most common types of payment plans available in the UAE:

a) 60/40 Payment Plan

The 60/40 payment plan is a popular option among buyers in the UAE. Under this plan, the buyer is required to pay 60% of the property's purchase price during the construction phase, while the remaining 40% is paid upon completion or handover of the property.

This payment plan provides buyers with the flexibility to manage their finances during the construction period and allows them to secure the property with a lower initial investment.

b) 70/30 Payment Plan

Following a similar structure, the buyer pays 70% of the property's purchase price during the construction phase and the remaining 30% upon completion.

Serving a slightly higher initial investment compared to the 60/40 plan, the 70/30 plan may come with additional perks such as extended post-handover payment periods or flexible payment schedules.

The 70/30 payment plan is favored by buyers who are financially prepared to commit to a larger down payment and seek to benefit from potential discounts or incentives offered by developers.

c) 40/60 Payment Plan

The 40/60 payment plan reverses the payment structure, requiring buyers to pay 40% of the property's purchase price during the construction phase and the remaining 60% upon handover.

This payment plan is particularly attractive to buyers who prefer to defer a significant portion of the payment until the property is completed and ready for possession.

The 40/60 payment plan provides buyers with greater financial flexibility during the initial stages of the property purchase and may be accompanied by favorable post-handover payment terms or installment options.

d) 80/20 Payment Plan

Buyers are expected to pay 80% of the property’s purchase price during the construction phase, with the remaining 20% due upon completion.

This payment plan is marked by a higher initial investment, making it suitable for buyers who are financially secure and seek to minimize their financial obligations post-handover.

The 80/20 payment plan may offer buyers the advantage of lower mortgage requirements and reduced long-term financial commitments, making it an attractive option for certain investors.

e) 50/50 Payment Plan

The 50/50 payment plan divides the property's purchase price equally between the construction phase and the handover phase, with buyers paying 50% upfront and the remaining 50% upon completion.

This balanced payment plan appeals to buyers who prefer a symmetrical financial commitment throughout the property purchase process and may offer the advantage of simplified financial planning and management.

Often accompanied by competitive pricing and potential discounts, the 50/50 payment plan makes it a viable alternative for buyers seeking a straightforward payment structure.

f) 10/90 Payment Plan

The 10/90 payment plan represents a unique approach to property purchases, requiring buyers to pay only 10% of the property’s purchase price during the construction phase, with the remaining 90% due upon completion.

This payment plan is particularly appealing to investors who wish to minimize their initial financial outlay and leverage the potential appreciation of the property’s value during the construction period.

The 10/90 payment plan may also be associated with extended post-handover payment terms, facilitating a more gradual and manageable financial commitment for buyers.

Rewards and Risks of Investing in Dubai Real Estate

Like any investment endeavor, Dubai real estate carries inherent risks and rewards that investors must carefully evaluate. Market volatility, regulatory changes, and economic uncertainties can pose challenges to real estate investors, impacting property values and investment performance.

Contrarily, the robust economic growth, tourism appeal, and infrastructure development present compelling opportunities for investors to capitalize on the market and perpetrate long-term capital appreciation.

1. Rewards

Dubai’s status as a global business and tourism destination has driven demand for residential, commercial, and hospitality properties, creating opportunities for investors to generate rental income and benefit from property value appreciation.

Moreover, the tax-free environment and ease of doing business in Dubai contribute to the attractiveness of real estate investments.

The development of mega-projects and infrastructure initiatives, such as Expo 2020 and the Dubai South master plan which is an integrated ecosystem to live and work, has the potential to enhance the value of real estate assets in specific locations.

These large-scale developments can stimulate economic growth, attract foreign investment, and elevate the overall appeal of Dubai’s real estate market.

More so, the diversification of the economy through initiatives like Dubai's vision for 2030 and the focus on innovation and technology create a favorable environment for real estate investments in emerging sectors.

2. Risks

Despite the promising rewards, investing in Dubai real estate carries inherent risks that investors should carefully assess. One of the key risks is the market volatility and cyclical nature of real estate.

The past decade has seen periods of rapid growth followed by market corrections, highlighting the susceptibility of the Dubai real estate market to external factors that tie in with economic slumps, geopolitical instability, and fluxes in oil prices which may impact market sentiment and property values.

Likewise, oversupply in certain segments of the real estate market poses a risk to investors. The rapid pace of construction and new project launches has led to concerns about oversupply in the residential and hospitality sectors.

An imbalance between supply and demand can exert downward pressure on rental rates and property prices, affecting investment returns.

The potential for changes in government regulations and policies, such as visa regulations and property ownership laws, can introduce uncertainties for investors.

Due Diligence and Investment Decision-Making

Conducting thorough due diligence is imperative before committing to any real estate investment in Dubai. This entails comprehensive market research, financial analysis, and property inspections to assess the viability and potential risks of a prospective investment.

Engaging highly qualified real estate professionals, legal advisors, and financial consultants can provide valuable insights and guidance in the decision-making process, ensuring that investors make well-informed and prudent investment choices.

Practical Tips for Investors

For individuals considering investment in Dubai real estate market, several practical tips can help navigate the intricacies of property acquisition, ownership, and management.

Conducting thorough research and due diligence is paramount, encompassing market analysis, property valuations, legal considerations, and potential risks.

Engaging the services of reputable real estate agents, legal advisors, and property management firms can provide valuable insights and guidance throughout the investment process, ensuring compliance with regulations and best practices.

Likewise, investors should assess their investment objectives, risk tolerance, and financial capabilities to determine the most suitable real estate opportunities.

Whether seeking rental income, capital appreciation, or portfolio diversification, aligning investment goals with the right property type and location is essential for long-term success.

Besides, staying informed about market trends, regulatory updates, and macroeconomic indicators can empower investors to make informed decisions and adapt to evolving market conditions.

Wrapping Up

Investing in Dubai real estate serves a myriad of opportunities for investors seeking to diversify their portfolios and capitalize on the city’s dynamic real estate market.

By understanding the market landscape, staying informed about market trends, and navigating legal and financial considerations, investors can place themselves to execute sustainable returns and wealth accumulation in the long term through strategic real estate investment goals all while the city persists to evolve and expand its global footprint.

Read More...